Top Credit Union Marketing Agencies

Julia Wild

- Last Updated: December 22, 2025

In This Article

Related Articles

If you’re a credit union looking for marketing agencies, you may be struggling with:

- Starting or scaling one or more marketing channels because your team doesn’t have the knowledge or bandwidth to reach your brand-awareness and member-growth goals.

- Finding an agency that has experience and a proven track record with credit unions. This includes agencies with expertise in creating and monitoring compliant creatives and content to maintain a good reputation with regulators and credit union members.

- Finding a credit union marketing agency that provides financial-specific reporting to track and analyze your marketing performance.

As an affiliate marketing agency that specializes in all sectors of financial services, we know credit unions have unique challenges. In this article, we’ll offer a list of possible marketing agencies that have expertise in credit union marketing and complement what we do. We’ll then share what we recommend credit unions look for in marketing agencies and what to have in place before working with an agency.

We’ll cover:

- Affiliate marketing for financial services companies: Fintel Connect

- Content marketing agencies for credit unions: BankBound, New Media Advisors and Mint Studios

- Full-service marketing agencies for credit unions: Hero Digital and HiFi Agency

- Credit Union PR agencies: Vested and Caliber

- Credit union growth marketing agencies: Onboard partners and Anchour

- Digital marketing agencies for credit unions: Crescendo, Session Interactive, Americaneagle.com and CatalystUX

- 6 questions to ask yourself before choosing an agency for your credit union

- What to look for in credit union marketing agencies: 6 tips

Want to learn more about how Fintel can help credit unions scale their affiliate program? Reach out to us today.

Affiliate marketing for credit unions and financial services companies: Fintel Connect

Since we’re the ones writing this article, we thought we’d start with ourselves.

Fintel Connect is an affiliate marketing agency working exclusively with financial services companies. It is a full-service solution, consisting of an affiliate tracking and reporting solution, a network, a compliance tool and agency support. We have years of experience making affiliate marketing work in highly regulated spaces, and know that credit unions face challenges that are sometimes unique from other financial institutions. Our team understands credit union organizations, products, and the broader market in which they operate, which means we can take a much more tailored approach to the channel.

Fintel Connect is an affiliate marketing agency working exclusively with financial services companies. It is a full-service solution, consisting of an affiliate tracking and reporting solution, a network, a compliance tool and agency support. We have years of experience making affiliate marketing work in highly regulated spaces, and know that credit unions face challenges that are sometimes unique from other financial institutions. Our team understands credit union organizations, products, and the broader market in which they operate, which means we can take a much more tailored approach to the channel.

We have worked with credit unions in the US and Canada and helped them promote the following products:

- Checking and savings

- Credit cards

- Insurance

- Mortgage and loans

- Investment and retirement

- Business banking and lending

Here are a few ways we are a good fit for credit unions looking for an affiliate agency:

Receive specialized program strategies and day-to-day management

Partnering with a generalist affiliate platform may work for you as a credit union if you have an affiliate specialist on your marketing team. But if you don’t, you’ll have to sift through low-quality publisher requests, and manage affiliate marketing campaigns alone. You’ll likely end up paying even more for agency services if you’re struggling to make the channel work or get the attention of your target publishers.

Fintel has a full affiliate agency service. We can launch or work with you to scale your affiliate channel without you needing to hire an internal affiliate expert or pay for additional agency services on top of a platform. We can act as an extension of your team because you don’t need to explain your product to us—we are all financial services marketing experts. You can get guidance on everything from strategy to the practical parts of campaign management, optimization and reporting.

You’ll get a team to work with you from day one and can start to see results more quickly because:

- We’ll work to understand your specific goals and needs and build a strategy that aligns

- We start pitching your products to publishers immediately

- Your team can get comprehensive onboarding help for everything from campaign tracking to importing existing affiliate partners

- We continuously work to grow and optimize the performance of the channel against your core KPIs and success metrics

Because we have a built-in affiliate network as part of our agency services, you won’t have to worry about having to find publishers appropriate for your credit union. You get to choose from thousands of specialized, vetted publishers familiar with working in financial services, ranging from large corporate sites like NerdWallet or Credit Karma, to news sites like US News, to influencers, apps, rewards sites and corporate affiliates, too.

Read more: Advertise on Sites Like NerdWallet and Bankrate: How to Get Started

Drive memberships via an agency that knows how to get results for financial services firms

We know how powerful affiliate marketing can be for member acquisition. But you need to have the right strategy in place to attract members to your credit union, without coming off as pushy or salesy in promoting your products.

We know how to help you achieve the right balance with the right ROI. Our team can guide you by testing your campaigns and messaging with every new publisher you work with. You’ll receive guidance on knowing when to partner with sites like Bankrate and NerdWallet, while we introduce you to lesser-known publishers who can connect you with your potential audience.

Our track record speaks for itself. We’ve helped many financial institutions achieve results, from credit unions like Coast Capital, Vancity, and Innovation to PSECU, OnPath and Service Credit Union.

See the details for yourself in the case studies of Neo Financial and Live Oak Bank, two of our financial services firms that both achieved important customer acquisition growth through the affiliate programs they built through Fintel Connect.

“Our team has been blown away by the level of customer service and overall results we’ve achieved with Fintel Connect. They provide unparalleled insight on how to optimize our affiliate channel and as a result, we are able to drive consistent awareness and growth of our products.” — Anika Leitl, Neo Financial Affiliate Marketing Associate

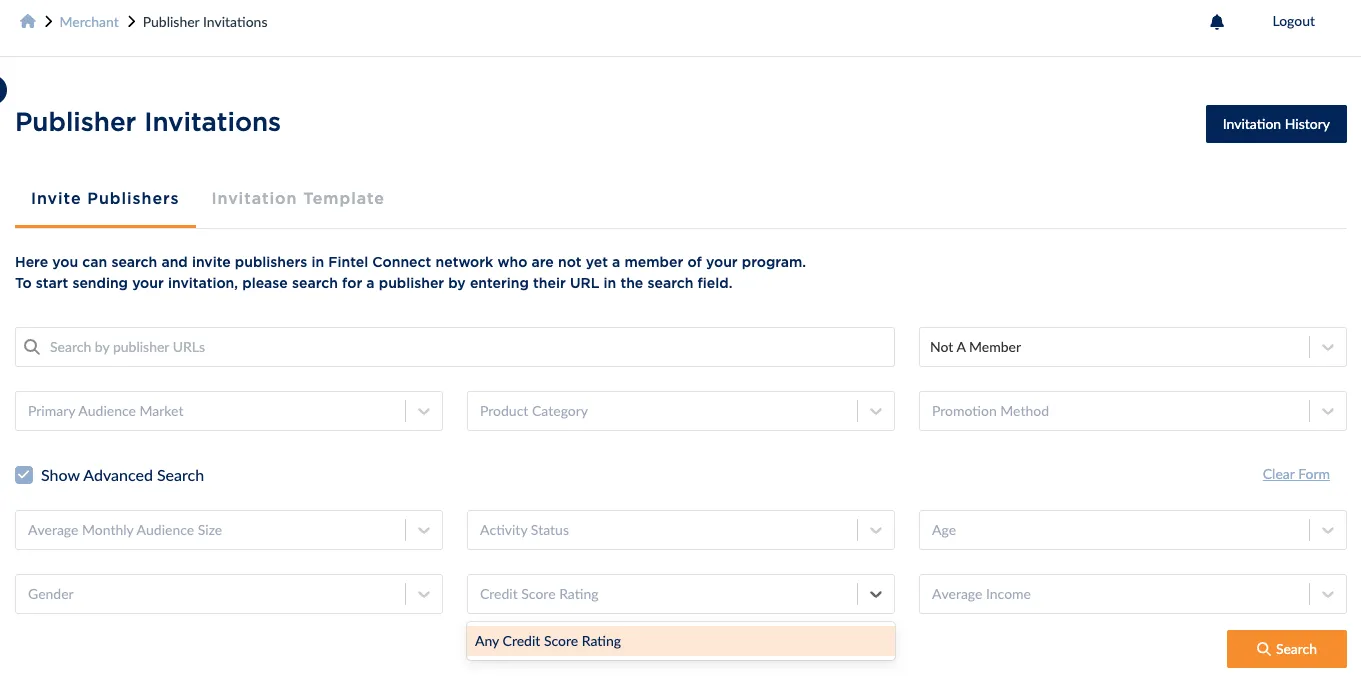

Partner with an agency that includes tracking, reporting, commission, and compliance monitoring, all specialized for financial services

At Fintel Connect, you’ll find an affiliate marketing software solution designed to serve the financial services industry and its unique needs.

As a credit union, we know you need robust reporting to help you understand your ROI. This is important both for your internal marketing team to ensure they are driving the most value from their work, and also to demonstrate to members and regulators that you are running your business responsibly. If your affiliate agency doesn’t meet your reporting needs, your team will end up filling the gap with painstaking work.

With Fintel, you can take advantage of specialized reporting and the ability to pay out commissions at various levels of the funnel. Because we use financial language throughout our software, you can get granular details on the metrics that matter to you most. You can track a viable lead, approved account, or funded loan. A robust knowledge of your funnel will help you prove ROI and improve your KPIs, as you will see exactly which stages are working and what you can further optimize.

You’ll also have access to real-time tracking you can integrate into your single source of truth. This tracking is end-to-end so you can follow the entire member journey. You’ll be able to look at the granular detail of what is happening in your funnel and customize your reporting to suit your needs. For example, you can customize by product type. This makes it easier to manage budgets by department or initiative, which can provide clarity for larger teams and more accurate reports.

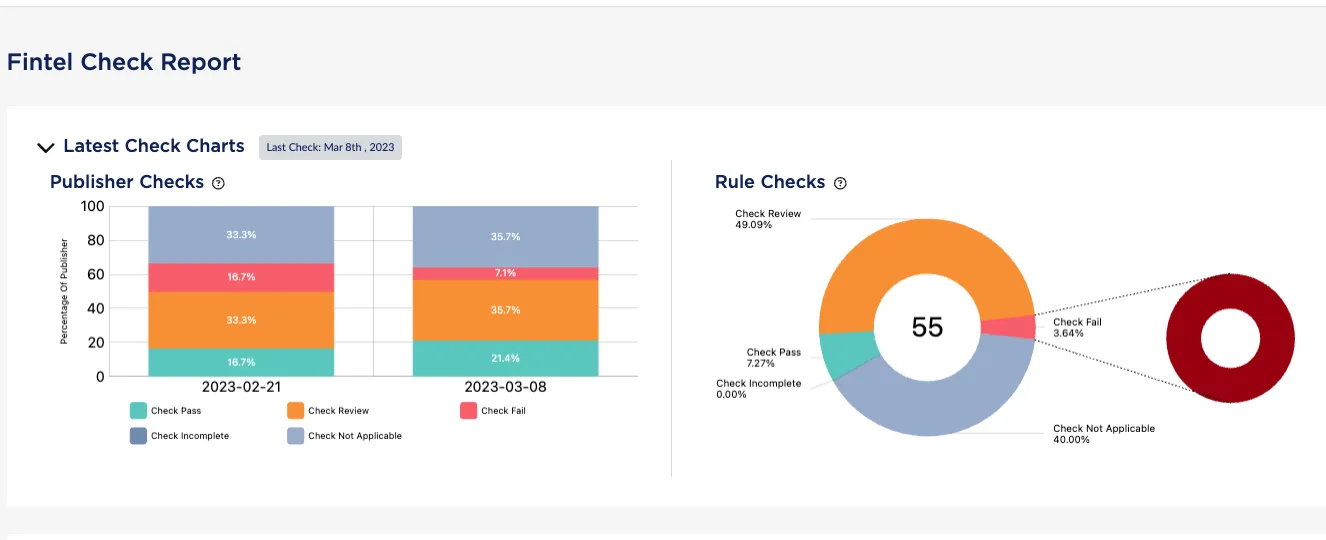

You’ll also get access to our marketing compliance tool for financial services, Fintel Check, which enables you to automate the compliance monitoring of your affiliate campaigns. We built our own tool because we saw first hand how other marketing compliance software wasn’t able to handle financial services requirements. With Fintel Check, you won’t be inundated with data because our rules-based engine enables you to choose to monitor only the information that matters most.

Read more about why we built Fintel Check

Who is Fintel Connect good for?

Whether you are looking to start an affiliate program from scratch, want to boost initial results or are ready to take a successful affiliate program even further, we are here to help, and can walk you through considerations and questions you want to be asking.

Want to learn more about how Fintel can help your credit union reach big marketing goals? Contact us or book a demo.

Content marketing agencies for credit unions: BankBound, New Media Advisors and Mint Studios

BankBound: Content marketing and SEO with digital agency services

BankBound is a digital marketing agency that specializes in working with financial services companies, including credit unions. With a focus on content marketing and search engine optimization (SEO), they have experience in serving credit unions’ digital marketing and content needs.

Features:

- Web design and development

- SEO and content services, as well as PPC and other digital marketing support

- Three-month trial offer so you can test digital channels

- Support for localization and local campaigns

Who BankBound is good for: If you are a smaller team that wants marketing strategy help as well as marketing execution, especially on web content and on some long-form content, BankBound could be a good fit.

New Media Advisors: Content marketing and SEO-focused digital agency

New Media Advisors work heavily in financial services with a proven track record supporting credit unions. They are content marketing specialists with a strong SEO capability as well as an emphasis on strategy and advising.

Features:

- Fractional CMO services

- Focus on website traffic and revenue through search and web assets

- Free brainstorming sessions to tackle digital marketing problems and assess fit

Who New Media Advisors is good for: If you are a credit union that wants to outsource content and SEO, New Media Advisors may be a good fit. If you need to improve your digital content strategy with a small team, their fractional CMO offering may boost your team’s expertise to formulate a new digital marketing plan without hiring.

Mint Studios: Content marketing agency for financial services companies

One specialized content marketing agency servicing North America, the UK, and Europe is Mint Studios. They focus on long-form content to help financial services companies like credit unions acquire members. They are a full-service content team and can support a variety of content goals as well as provide robust reporting to demonstrate clear results.

Features:

- Long-form content for financial services, including thought leadership and results-based content strategy

- Support outsourcing of content creation, including interviewing, strategy, writing, publishing and reporting

- Have an SEO and lead-generation specialty

Who Mint Studios is good for: Credit unions looking to hand off part or all of their content marketing as a function to an outside team.

Full-service marketing agencies for credit unions: Hero Digital and HiFi Agency

Hero Digital: Full service digital agency

Hero Digital is a full-service media agency that has a dedicated team for financial clients, including banks and credit unions. They offer a wide variety of services to support your marketing efforts across channels.

Features:

- Media agency support

- Experience design, audience research and performance optimization

- Paid media

- App development

Who Hero Digital is good for: If you are a credit union who wants to outsource the development of digital channels, or who wants broad marketing support across multiple channels, Hero Digital may be a fit for you.

HiFi Agency: Full service creative and media agency

If you are looking for a full-service agency, HiFi is another option that specializes in financial institutions and has experience with credit unions. They can support a wide range of functions, from brand development to PPC.

Features:

- Web and website design

- Social media marketing

- Marketing automation

- Scripted content and animations

Who HiFi is good for: Credit unions that want a full-service agency with breadth across the gamut of digital marketing and media may find HiFi a good fit.

Credit Union PR agencies: Vested and Caliber

Vested: PR agency with financial expertise

Credit unions who need help with PR and branding may consider Vested, which is a PR communication and marketing consulting agency with a history of financial services experience. They have offices in the US, UK and Canada.

Features:

- PR, including executive communications

- Crisis communication

- Some digital marketing and traditional ad services

Who Vested is good for: Vested may be a good fit for credit unions that want to focus on brand and PR outreach, traditional advertising and digital marketing.

Caliber: PR agency and marketing messaging for financial services

Caliber is a longstanding PR firm with ample financial services experience, including credit unions. They also have digital media support.

Features:

- PR, including targeted media placements

- Branding and marketing messaging

- Social media and digital marketing services

Who Caliber is good for: If you are a credit union in the US who primarily needs brand messaging and brand strategy help, Caliber may be a fit for you.

Credit union growth marketing agencies: Onboard partners and Anchour

Onboard Partners: Growth expert agency

Specialists in both strategy and operations, Onboard Partners are a growth agency that can help credit unions optimize customer acquisition and maximize lifetime value. They are a performance-focused agency that also offers a partnership in deploying capital or finding funding partners.

Features:

- Performance marketing

- Portfolio solutions, including financing and underwriting options

- Partnership services, including finding and maintaining business partnerships

Who Onboard Partners is good for: A credit union that wants help with developing products and capital deployment, not just digital marketing channels, may look into Onboard Partners. If you have goals of developing business partnerships, they may also be an option to consider.

Anchour: General marketing agency

Another all around agency to consider is Anchour. They offer a variety of support for digital marketing, including branding and growth marketing. They focus on financial services with a specific emphasis on credit unions and banks.

Features:

- Content and strategy, including brand positioning and copywriting

- Website UI and UX

- Performance marketing

Who Anchour is good for: A credit union that wants an agency that can guide marketing across multiple digital channels should consider Anchor. Those looking for help with developing brand positioning and updating their website and digital user experience would also benefit from working with Anchour.

Digital marketing agencies for credit unions: Crescendo, Session Interactive, Americaneagle.com and CatalystUX

Crescendo: Digital marketing and strategy

If you are a credit union focused on lead generation and are looking for a flexible partner, Crescendo may be a good fit. They offer a variety of digital marketing services, including website support, and have worked with credit unions before.

Features:

- Email marketing, SEO and content

- Paid ads and PPC

- Month-to-month contract options for trying a new channel without long-term commitment

- Free advisory call and marketing audit as well

Who Crescendo is good for: Credit unions that want to experiment with digital marketing channels or scaling through an agency may be a fit for Crescendo.

Session Interactive: Digital marketing agency

Session Interactive is a digital marketing consultancy that supports both a variety of digital marketing services as well as localization. They have experience with credit unions in particular and focus on digital strategy and lead generation.

Features:

- Paid search and paid social

- SEO and content marketing

- UX/UI

Who Session Interactive is good for: If you are a credit union that wants consulting and strategy support across your digital marketing channels in order to improve lead generation, Session Interactive may be a good fit for you.

Americaneagle.com: Web development and digital marketing agency

Americaneagle.com has over 25 years of experience as a web solution and digital marketing agency. They focus on providing expertise and implementation across a variety of digital services, and have historically worked with financial companies, including credit unions.

Features:

- Web application development and UX design

- Web hosting and security

- Digital marketing, including SEO, PPC, and social

Who Americaneagle.com is good for: Credit unions who need to solve back-end web problems as well as grow digital channels may benefit from Americaneagle.com’s expertise.

CatalystUX: Design marketing agency

CatalystUX is a subsidiary of Unosquare that specializes in UX and application modernization for a handful of fields, including financial services companies. They are a design marketing agency with a focus on digital design and support of digital services.

Features:

- UX design

- UX research

- Technical architecture, including cloud and infrastructure solutions

Who Catalyst UX is good for: A credit union who wants a partner to develop and design their digital user experiences, and who either needs to establish or update their digital offerings, may consider Catalyst UX.

6 questions to ask yourself before choosing a marketing agency for your credit union

Ideally, your marketing team will have already tested certain marketing tactics and have a strong understanding of your own strengths and weaknesses before you search for an agency. As an affiliate marketing agency, we sometimes come across credit unions that aren’t yet ready to take on the channel. This is most often in cases where they haven’t yet worked out product-market fit in a digital capacity and what success would look like to them.

So, before you start researching agencies, ask yourself:

- What are my marketing needs? This is the first (and most important) question to answer, so you’re clear on what kind of support you need. Is it resource backfilling, experimentation in a new area, optimization or other?

- What is your marketing budget and how much do you want to allocate to an agency? Coming in knowing what you can afford will not only set expectations for you, it will help agencies tailor their proposals to your budget and goals. This will help you narrow your search to agencies within your budget.

- Which channels do you want to improve and what are your KPIs? Answering these questions helps you find an agency with the right services focused on the right results. While your KPIs will vary, you should always expect an agency to have tracking and reporting by product category so you have an understanding of metrics on the granular level. This will ensure that you are getting ROI for your marketing spend.

- Is your conversion pipeline working? Unless you’re looking specifically for a marketing agency that can help improve your user experience (UX), landing pages and funnel, make sure new members can convert through your digital channels. Otherwise, you risk wasting money funnelling people onto your landing pages, only to have them fail to become members.

- Do you have product-market fit before you invest more budget into marketing? Ensure you’ve clearly defined your target audience for your products before choosing an agency. Often agencies can help with testing this. But only you, as the client, can determine what’s right for you.

- What is your member lifetime value (LTV)? A clear idea of member value can indicate how much you’re willing to spend to acquire more members. It will also help you benchmark your marketing efforts to revenue. This is key to understanding the return you will get from your agency spend.

Now that you’ve ensured your marketing team is prepared for a successful agency search, here are a variety of marketing agencies that have experience with credit unions. Each has their own specialty, from full-service to UX, so we’ve divided them into categories to help you find what you’re looking for.

What to look for in credit union marketing agencies? 6 tips

We have worked closely with countless credit unions looking for a marketing agency and know they face unique challenges that set them apart from other financial institutions. In our experience, here are six things to consider when choosing an agency partner for your credit union:

- They have industry expertise in credit unions specifically. Some agencies with financial services experience don’t have direct knowledge of credit unions, so they don’t know your unique compliance regulations or member messaging requirements. Look for case studies or a landing page that specifically showcase an agency’s past work with credit unions and how they will navigate your marketing needs and member relationships.

- They can help you maintain regulatory compliance. An agency should not only have knowledge of marketing regulatory compliance, but should also be prepared to work with your compliance team as a part of their processes. Speak with your own compliance team to nail down their expectations before meeting with an agency. You may also want to consider agencies that also offer software tools to help you monitor marketing content for compliance, which cuts down on costs and complexity.

- They offer reporting transparency with a financial focus. An agency needs to demonstrate how they are helping you meet your marketing goals through regular reporting of financial focused metrics, such as loan application values. Ensure the reporting frequency, as well as language and metrics, are what your marketing and compliance teams need.

- They have a good reputation among your colleagues and peers. As you are doing your research to find an agency, talk to others in your industry about who they have worked with, what projects they have outsourced, and if they had a good experience with a marketing agency. Read reviews of companies as well.

- They have services that complement your team’s knowledge and/or skill gaps. Knowing what gaps your team has will determine what type of agency support works best. For example, if you want to start a new channel but have no expertise, you may outsource that entirely. But if your team is skilled and wants to ramp up their multiple existing channels without hiring, you may seek help across the board from a full-service agency.

- They support you with clear processes that fit your workflow. A marketing agency should be able to tell you how their processes work, what their pricing is, how they schedule deliverables, how they measure progress and communicate with your team. Look for a clear point of contact and personalized support with a high level of transparency, and ask questions about how they can support your team.

Choose the right marketing agency for your credit union

Even if it may be more cost-effective than hiring, investing in a marketing agency is a big decision that can shape the growth of your credit union. And with all the extra red tape and transparency required of credit unions, you need a partner who understands what your marketing and compliance teams require.

If you are a credit union who is looking to start, scale, or improve your affiliate marketing with a knowledgeable partner, contact us today.

Sources:

- https://www.bankbound.com

- https://www.newmediaadvisors.com/

- https://www.mintcopywritingstudios.com/

- https://herodigital.com

- https://hifiagency.com

- https://fullyvested.com

- https://www.calibergroup.com/

- https://onboardpartners.com/

- https://www.anchour.com

- https://crescendoconsulting.co

- https://sessioninteractive.com

- https://www.americaneagle.com/

- https://catalystux.com

Credit union marketing agencies Frequently Asked Questions

1. What type of marketing agencies are best suited for credit unions?

The best agencies for credit unions typically specialize in financial services and understand the regulatory environment. These include affiliate marketing agencies like Fintel Connect, content marketing agencies like BankBound or Mint Studios, full-service digital firms like Hero Digital, and PR-focused teams like Vested.

2. How is affiliate marketing useful for credit unions?

Affiliate marketing connects credit unions with trusted publishers who help promote financial products like checking accounts, credit cards, and loans. It’s a performance-based channel where you only pay for conversions, making it cost-efficient and scalable.

3. Are there full-service agencies with credit union expertise?

Yes. Hero Digital and HiFi Agency offer full-service marketing across web, brand, digital, and media. These are good fits for credit unions needing comprehensive marketing support under one roof.

4. What should credit unions look for in a marketing agency partner?

Key considerations include: industry experience with credit unions, ability to ensure regulatory compliance, reporting transparency, compatibility with your team’s skillset, a strong track record, and a workflow that aligns with your operations.

5. How can credit unions ensure they’re ready to work with a marketing agency?

Before engaging an agency, credit unions should clarify their marketing goals, confirm product-market fit, ensure their digital conversion pipeline is functional, understand their budget and KPIs, and know their member lifetime value.